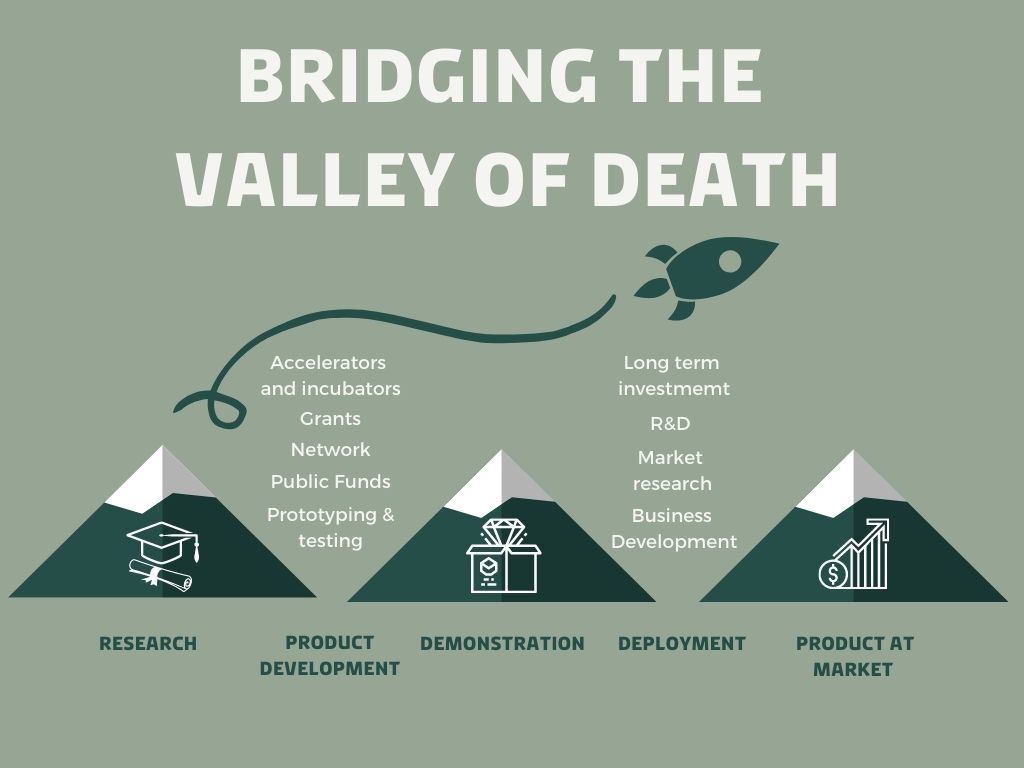

University spin-outs, small businesses aiming to commercialize the knowledge and technologies produced at research labs and institutions, are a key driver of innovation. They translate ground-breaking research findings into scalable solutions. However, there are several hurdles on the path from lab to global impact: complex IP landscapes, the "valley of death" in funding, and the need for solid market validation, especially for capital-intensive projects like those needed for energy, manufacturing, public infrastructure, and national security.

The Critical Importance of Strategic Framing

For US-based spin-outs, securing non-dilutive federal funding in the current US environment demands more than just technological merit; it requires strategic alignment with agency priorities and the political realities of an ever-changing set of players and agendas. Founders must be acutely aware that certain terms and narrative framing can significantly impact an application's reception. The key is to refocus the narrative on universally supported, high-priority national goals.

Core Hurdles Remain

Beyond this critical framing, US-based deep tech spinouts also have to navigate the dramatic retreat in federal funding support. Recent policy shifts, including the effective shutdown of the DOE's Office of Clean Energy Demonstrations (OCED), deep cuts to NSF budgets, and the pausing of initiatives like ARPA-E SPARKS, underscore a harsh reality. Nevertheless, non-dilutive grants remain a crucial competitive advantage and risk mitigator; founders must now navigate this constrained environment with heightened strategic agility and realism. This analysis, focused on hardware-intensive climate projects, examines enduring hurdles and adapts the grant strategy for today's challenging realities.

1. Intellectual Property: Securing the Strategic Moat (Beyond Protection)

A spinout's IP constitutes its core defensibility and valuation driver, not just a legal requirement. Effective negotiation with technology transfer offices (TTOs) is a critical strategic activity. While the equity split may vary (e.g. Stanford/MIT: 3-5%, others may be higher), negotiations should emphasize structures that allow for long-term scalability of the company:

- Milestone-Based Royalties: Advocate for agreements that tie institutional returns directly to revenue generation from the company. This approach preserves founders' equity and fundamentally aligns university incentives with commercial success and goes beyond patent filing criteria.

- Exclusive Licensing: Non-exclusive licenses entail considerable risks for large-scale climate tech projects. Securing exclusivity in target markets/applications is critical to attracting serious investors and partners.

- Express Licenses: Proactively seek pre-negotiated licensing agreements. Speed is of strategic importance; delays in finalizing intellectual property agreements directly impact a venture's ability to scale climate solutions.

2. Market Validation: De-risking Demand with Grant-Fueled Traction

For deep tech climate spinouts, especially those developing capital-intensive solutions like grid storage, carbon capture, or green hydrogen, traditional VC funding is often unavailable early on due to significant market and technology risk. Grants have historically been the strategic spearhead for market validation:

- Targeted Proof via Grants: Utilize non-dilutive grants (e.g., ARPA-E programs) to fund rigorous customer discovery and pilot deployments. The objective extends beyond technical validation to proving the economic model and willingness-to-pay for large-scale solutions.

- Quantifying the 10x Advantage: Grant funding enables studies and prototypes that demonstrably prove a solution offers order-of-magnitude improvements (efficiency, cost, emissions reduction) over incumbents. This data is invaluable for future investors and customers.

- Letters of Intent (LOIs) as Strategic Leverage: Securing LOIs from potential anchor customers or partners early significantly strengthens grant applications (e.g., STTR/SBIR, DOE grants) and provides tangible evidence of market pull, de-risking the project for funders and investors.

3. Funding Strategy: Grants as the Non-Dilutive Launchpad & Leverage

For large-scale climate tech ventures, grants are foundational strategic capital, not optional extras. They bridge the critical funding gap and validate technology for subsequent investment rounds:

- SBIR/STTR: The First Strategic Validator: Winning competitive Phase I/II awards signals technological credibility and market potential to VCs. Applications should explicitly frame these grants as stepping stones to commercial scale.

- Targeting Early Stage-Specific Catalysts: In the current climate, spinouts must aggressively pursue resilient, non-dilutive funding sources explicitly designed for de-risking deep tech. Prioritize corporate-public partnership programs like the DOE's American Made Challenges (rapid innovation prizes) and the 100+ Accelerator (corporate-backed sustainability validation), alongside state/regional grants (e.g., NYSERDA, CA Clean Energy Fund).

- Strategic Grant Stacking & Sequencing: Utilize smaller proof-of-concept grants (e.g., university funds, innovation challenges, and state programs) to generate critical data required for larger federal applications. This sequential approach primes the venture for Series A and beyond.

- Leverage for Dilutive Rounds: Spinouts entering VC negotiations with significant non-dilutive capital secured demonstrate execution capability, reduce the capital required from VCs (improving terms), and showcase government co-investment, substantially de-risking the proposition for investors.

4. Building the A-Team: Strategic Resourcing Enabled by Grant Capital

A team that balances science with startup experience is far more fundable and resilient. Grants provide essential capital to strategically build the team leadership:

- Funding Critical Commercial Hires: Large grant proposals should explicitly budget for essential commercial roles (business development, operations, finance). This investment is fundamental de-risking, enabling ventures to hire seasoned operators before Series A.

- Accessing Fractional Expertise: Grant funds can be allocated to platforms like Midlands Mindforge for fractional C-suite talent, providing vital commercial guidance without the burden of early-stage full-time salaries.

- Strengthening Applications with Commercial Acumen: Including experienced commercial leadership within the core team significantly bolsters grant applications focused on market impact and deployment strategy.

Conclusion: Grants – The Strategic Engine for American Tech Leadership

Achieving impact at scale demands a founder-centric approach where strategic alignment with funding mandates and grant acquisition are inseparable core competencies. The current funding environment necessitates:

- Meticulous Terminology & Framing: Consciously articulating technology value propositions within the established pillars of domestic supply chains, advanced manufacturing, energy independence, national security, and economic competitiveness, ensuring direct relevance to agency goals.

- Targeted Program Selection: Prioritizing grant programs explicitly defined by legislation or agency strategy to support these national priorities.

- Execution Excellence: Leveraging non-dilutive capital to de-risk technology, prove market viability within the strategic frame, build leadership teams, and position for investment.